Growth Through Challenges

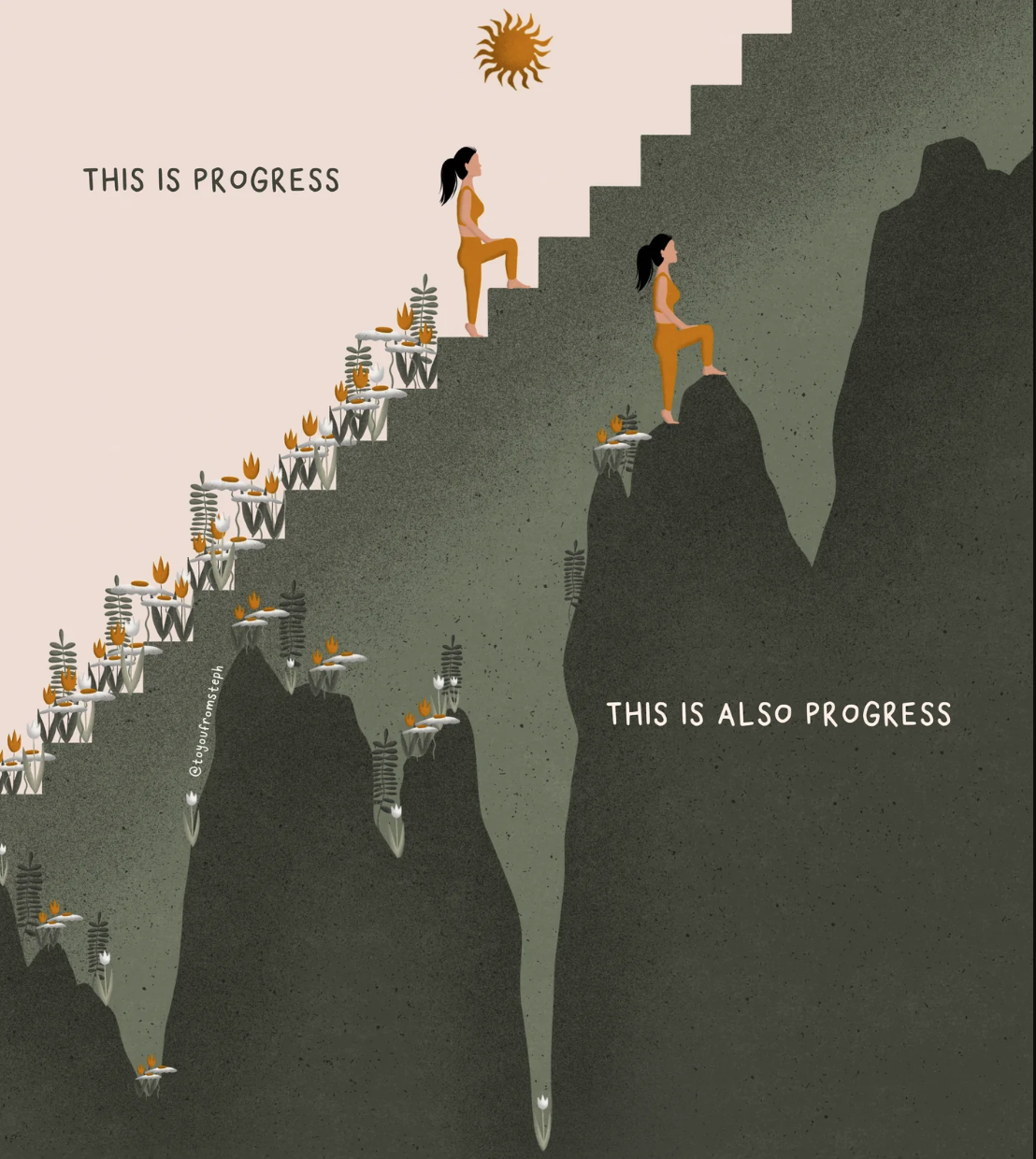

Growth mindset is one of the most powerful positions an investor can take in their approach to facing obstacles in their experiences.

Beyond the Numbers: Evaluating Deals, Mitigating Risks, and Balancing Qualitative & Quantitative Analysis

Deal analysis has the person, the property, and the proof. Quantitive analysis alone is insufficient when the human operator is the the main reason why deals will fail and loans will default.

Why Sell Your Property Creatively?

While creative solutions aren’t always a good fit for everyone, they’re an excellent solution when the traditional market is unable to get sellers what they need. If you have ever wondered “why would anyone ever sell their house subto?” you are not alone. There are a couple situations in which creative financing, such as selling subject to the existing mortgage or seller financed, is an excellent option.

Are you secure?

Security isn’t simply a lien, mortgage, or deed of trust. There’s some evaluation to ensure there’s sufficient equity.

Underwriting vs Comping - They're Different

Underwriting and comping while they play hand in hand have some nuances to consider

Fraud or Incompetence… does it matter if the result is the same?

Real estate fraud schemes are plentiful and always changing. There are risks you can assess tat may not be an outright criminal act, but the result of losing your hard earned cash, time, and energy is the same.

Top Tips for Private Lending in Real Estate

Top six tips for doing better due diligence for private lenders. Attorneys fees, court, and loan remedies are expensive in time, money, and energy. To succeed in private lending, you must take preventative steps to safeguard your investment. We've devised our list of the top tips for successful private money lending in real estate.

Borrower Verification and Private Lending Due Diligence

Take a holistic approach to conducting due diligence and do not trust, verify. Look at the deal, the person, and the proof to confidently private money lend and partner with investors.

Private Money Lending: Unlocking Wealth in Real Estate

Passive Income with Creative Finance

The door to passive investing in real estate can be opened with private money lending. No time, no knowledge, no problem. Due diligence is your friend and truly passive income can be achieved.

Private Money Lending: The Importance of Due Diligence and Protecting Your Investments

Double-digit returns. Asset-backed loans. They all say the same thing. Private Money Lending pitfalls to consider, avoid, and reduce investing risk.

Creative Financing Options You Need to Know

Buying real estate can be an expensive endeavor, and it's not always easy to come up with the cash needed to make a purchase. But fear not, because there are some creative ways to finance your real estate dreams without the bank.

Partner Up to Level Up

Explore why partnering with others can add experience, expertise, or knowledge.

Land Development Lessons

Dirt lot development, planning, permitting, and lessons learned.

Progress is Not Linear

Setbacks can stimulate growth. By reframing our perspective and looking for the silver lining in difficult situations, we can cultivate a sense of gratitude and appreciation for the lessons learned, even in the face of adversity.

Community & Coaches

It can feel lonely and scary learning new things. Don’t do it alone and find your teacher, coach, mentor, and community.

Intentional Investing

Shiny object syndrome is real and there are so many ways to make money in real estate. If you don't have a specific goal in mind, no investment will be right for you and you’ll get lost in the endless options.

Partnerships, Service, Communication & Boundaries.

Boundaries and communication can save your time and energy while building stronger relationships with those that share your values.

The Basic Art of Comping Single Family Properties

Understanding comparable properties can save investors from costly mistakes in fix-and-flips.

Will this make me money?

How do you know if an investment property will make you money? There are ways to look at a deal on the surface level to calculate potential cash flow.